Demand for fintech jobs is going through the roof!

The financial services business is gradually evolving into a high-tech business with an infusion of IT and data science and new technologies like artificial intelligence, blockchain, cloud-based services, etc., in order to provide an unparalleled level of convenience and productivity in the hands of the users. It is revolutionizing the way we invest and spend our money as also the best possible way we can save and manage our money. Hence, fintech career opportunities are immense.

Initially, Fintech emerged on the scene as an alternative solution to financial institutions. However, considering new developments, the lines have blurred in recent years.

There has been a growing trend of fintech businesses pursuing bank charters, and in turn, banks are now nurturing relationships with fintech companies to fulfill consumer demand in a better manner—a total transformation of both the fintech and traditional financial services domain.

Therefore, both fields have been affected by new rules and regulations amid the evolution of technology. As a result, the risk of regulatory scrutiny and obligations have increased simultaneously, causing the need for compliance experts to appear on the scene.

In addition to compliance, risk management and control functions are also in demand. More financial companies are now looking for specialists to analyze, prevent and mitigate risks, including regulations, operations, and financial fraud.

This has resulted in a never-dreamt-before job opportunities in fintech industry for the people in this sector because it has now become quite multi-disciplinary, absorbing people from non-finance areas such as STEM into its fold. No wonder, fintech job market is booming!

Fintech will also require people with the ability to rope in suitable technology partners in their business and work with and manage cross-functional teams and deliver results in a time-bound manner. Thus such managers would require to have a thorough understanding of the contribution of various multi-disciplinary functions as also soft skills of effective communication and team building.

There being a large number of technology partners and freelancers (with various specializations) at remote locations, managing such a multi-disciplinary team may be a real challenge for such fintech firms.

An MBA with a specialization in Fintech may just be on the horizon to catch up with this trend. The CEOs and other senior members of such companies now require to have a deep understanding of how to integrate technologies into their financial services products to find a better competitive edge in the market.

In their ‘The Big Tech In Fintech Report: How Facebook, Apple, Google, & Amazon Are Battling For The $28.2T Market’, CB Insights (www.cbinsights.com) has mentioned the major initiatives of such big tech companies:

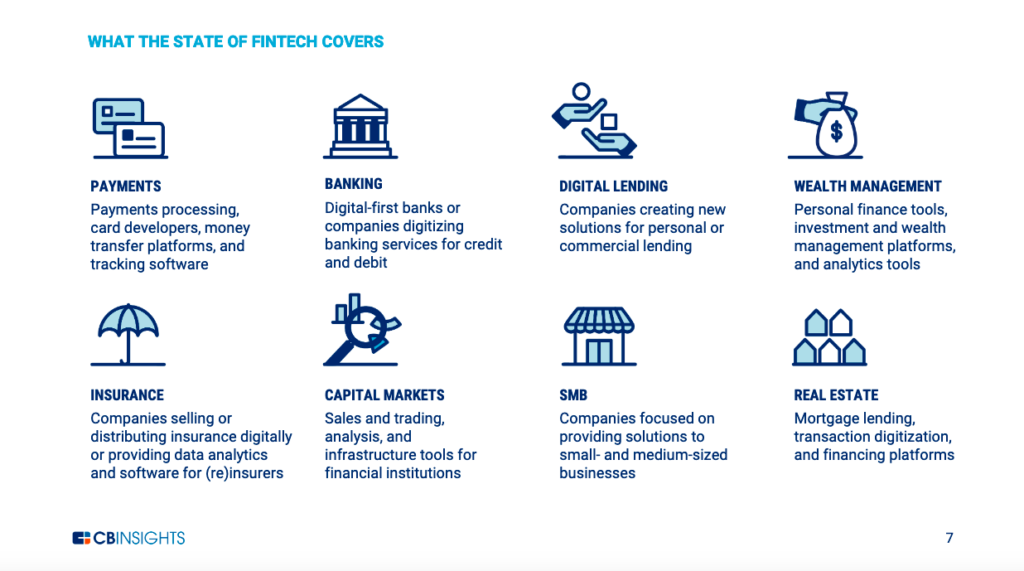

As reported in the article by CB Insights (https://app.cbinsights.com/research/report/fintech-trends-q2-2021/), the following picture gives an overview of the 8 major sectors where fintech is making its mark.

Industry Uses

As per TechBullion (https://techbullion.com) here are the 10 most popular fintech sectors.

- Mobile Banking – with the help of an app.

- Internet Banking – online banking.

- Blockchain

Blockchain refers to a decentralized digital ledger that can record transactions across multiple computers such that the recorded transactions cannot be altered retrospectively. Participants can, therefore, audit and verify the transactions in a simple and cost-effective way. Blockchain is an online platform for digital assets. Bitcoin is the digital currency commonly used in blockchain transactions and it is gaining popularity as more and more people embrace fintech.

Fraud detection using blockchain technology

- Insurance fraud costs more than $40B a year and is difficult to detect using standard methods.

- Blockchain’s shared ledger technology can move fraud detection forward by consolidating claims data across insurers.

- By facilitating better data sharing, blockchain technology can save insurers the expense of paying for public and subscription data to prevent fraud.

- There are many such uses of blockchain technology to ensure risk-free financial transactions.

4. Insurtech

Insuretech is the use of financial technology in the insurance industry. Many insurance companies are adopting the use of technology and it is now possible to take an insurance cover without having to physically present yourself to the company. An individual can also file claims online.

5. Predictive Analytics

Predictive analytics is the use of big data to forecast future occurrences. The fintech sector involves the use of Big Data by finance institutions to determine market trends and future profitability.

6. Crowdfunding

Crowdfunding is a rapidly growing fintech sector. Every year, up to $3 billion is raised on US-based crowdfunding platforms. The entry of early startups in the sector has significantly contributed to its overall growth.

7. Peer-to-Peer Lending

Peer-to-peer lending involves ordinary people offering credit to those who need it without involving a financial institution as an intermediary. A P2P platform connects loan providers with prospective borrowers. The process allows quick, simple, and fast access to credit.

8. Smart Finance Management

The advancement in fintech makes personal finance management easier to all irrespective of their academic background. Apps are capable of managing accounts, automatic budgeting, asset management, and financial planning.

9. Innovative Payments

Innovative payments are an important fintech sector especially in the light of increasing globalization and e-Commerce. It is estimated that by 2019, over 5 billion people will be making digital payments.

10. Robo-advisors

Robo-advisors are software that uses algorithms to help people make informed investment decisions. Robo-advisors are gaining prominence in the financial industry particularly in portfolio management and stock markets where they make trading intuitive, cheap, and mobile.

As reported by Visual Capitalist (https://www.visualcapitalist.com/current-fintech-industry/), both China and India are the leading players in the Fintech sector, as compared to other countries:

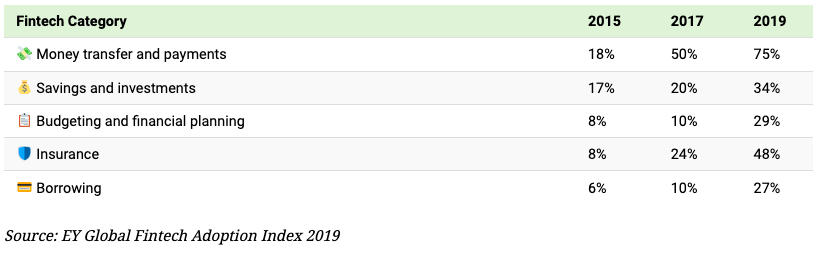

Visual Capitalist (https://www.visualcapitalist.com/current-fintech-industry/) has shown this image depicting the rate of adoption of fintech by different fintech categories over the last few years.

This has been the growth of fintech adoption for different categories over the last few years:

Top Companies

PayPal is one of the most well-known fintech companies, with a transaction volume of $333.8 billion in 2019. (Paypal, 2020).

However, some of the biggest names in the fintech industry that have come up recently are:

- Ant Group

- Stripe

- Adyen

- Paytm

- Coinbase

- Robinhood

- Square

- Klarna

- SoFi

- Credit Karma

CB Insights (https://app.cbinsights.com), in their Fintech 250 (2020) report, has mentioned the following startups that are most well funded.

- Accounting & Finance – AvidXchange

- Asset Management – Addepar

- Business Lending & Finance – BlueVine

- Capital Markets – Trumid

- Core Banking & Infrastructure – Symphony

- Credit Score & Analytics – Future Finance

- Cryptocurrency – Coinbase

- Digital Banking – Nubank

- Financial Services & Automation – Unqork

- General Lending & Marketplaces – Konfio

- Insurance – Oscar Health

- Mobile Wallets & Remittances – Grab

- Payments Processing & Networks – Stripe

- Payroll & Benefits – Gusto

- Personal Finance – Varo Money

- POS & Consumer Lending – Klarna

- Real Estate & Mortgage – Figure Technologies

- Regulatory & Compliance – Onfido

- Retail Investing & Secondary Markets – Robinhood

This website provides specific details of the Top 50 Fintech Companies in India:https://securenow.in/insuropedia/top-50-fintech-companies-india/

Market Size

According to a recent study made by Gartner (https://gartner.com) by the year 2025, the business value added by blockchain will be more than $176 billion, then further increase to $3.1 trillion by 2030.

As per FinancesOnline (https://financesonline.com/fintech-statistics/), the following are the major points to be considered:

1. Fintech market share across 48 fintech unicorns is worth over $187 billion as of the first half of 2019, or slightly over 1% of the global financial industry.

2. The global fintech market is expected to grow at a CAGR of 23.58% from 2021 to 2025. (Research and Markets, 2020).

3. Artificial intelligence is one of the leading technologies in the fintech market, with a market share of 38.25% in 2019. (Research and Markets, 2020).

4. Blockchain and regulatory technology (regtech*) are the fastest-growing segments of the fintech industry. (Grand View Research, 2019) (Transparency Market Research, 2018).

5. Fintech market report in Asia, particularly China and India, shows that the region has the fastest growth in fintech consumer adoption. (Bloomberg, 2019).

6. $26.5 trillion is the projected value of the global financial services market, by 2022.

7. In 2019, 64% of consumers worldwide have used one or more fintech platforms, up from 33% in 2017. (Ernst & Young, 2019).

8. Up to 28% of banking and payment services will be at risk of disruption due to new business models brought about by fintech. (PwC, 2020).

9. Up to 22% of companies in the insurance, asset, and wealth management sector will be at risk of disruption due to new business models brought about by fintech. (PwC, 2020).

10. Companies that use robotic process automation for banking tasks see a return on investment of 100% within three to eight months. (Medium, 2020).

11. In the first half of 2019 alone, digital payment has reached $4.1 trillion. (Statista, 2021).www.tipalti.com

What is Regtech*?

As defined by Tipalti (www.tipalti.com) Regtech is the use of technology to manage regulatory compliance processes within financial institutions. Regulatory Technology comprises emerging tech such as machine learning and blockchain, to ultimately help businesses lower the cost and increase the efficiency of complying with regulations.

Top RegTech companies include:

- Analyze N Control

- IdentityMind GLobal

- Alessa

- ScribeStar

- Accuity

- Trunomi

- PassFort

- 6clicks

- FundRecs

- Suade

The regtech space is considered a subcategory of fintech (financial technology) with an objective to enhance transparency, bring on consistency, and standardize regulatory processes. The goal is to deliver sound interpretations of confusing regulations that provide higher quality at a lower cost.

As researched by CB Insights (https://cbinsights.com), a very interesting scenario is emerging for the Fintech sector as a whole, owing to the overall impact of Covid 19 on businesses.

How to start a career in Fintech?

The fintech industry is thriving. Innovation continues to transform this field and will do so for the foreseeable future. Job seekers eager to become a part of this growing domain are those who seek to redefine traditional methods with evolving technology.

From programming to AI and beyond, a career in fintech is teeming with endless opportunities.

Such seemingly dramatic development in this field has now given rise to the following new job roles in financial services companies:

- Blockchain Developer

As reported by the Blockchain Council (https://www.blockchain-council.org/), Mehul Patel, the CEO of Hired, said that the growth in demand for blockchain-certified professionals has gone “through the roof.”

According to the job search platform, Hired, there has been a 517% increase in demand for software engineers having knowledge in blockchain development, in the past year.

Blockchain developers are required to design, implement, and distribute a secure blockchain-based network for secure, fast, and efficient digital transactions. They analyze the blockchain needs, design customized blockchain technologies, and launch and maintain the blockchain network.

Blockchain developers should have extensive knowledge of programming languages used for blockchain development and experience in cryptography.

According to Betterteam (www.betterteam.com), Blockchain Developer’s responsibilities and requirements are as follows:

Blockchain Developer Responsibilities:

- Collaborating with managers to determine blockchain technology needs and envisaged functionalities.

- Creating application features and interfaces by using programming languages and writing multithreaded codes.

- Applying the latest cryptology techniques to protect digital transaction data against cyberattacks and information hacks.

- Maintaining client and server-side applications.

- Optimizing and securing blockchain applications by integrating new tools and technologies.

- Educating sales personnel on blockchain features that allow secure digital payments.

- Documenting blockchain development processes and complying with best practices in data protection.

- Keeping up with current blockchain technologies and cryptography methods.

Blockchain Developer Requirements:

- Bachelor’s degree in information security, computer science, or related.

- At least 2 years of experience as a blockchain developer.

- Advanced proficiency in programming languages, such as C++, Java, and Python.

- Extensive experience in back-end development, algorithms, and data structures.

- Knowledge of cryptography and blockchain protocols.

- In-depth knowledge of best practices in blockchain management and data protection.

- Advanced analytical and problem-solving skills.

- Superb organizational skills and keen attention to detail.

- Excellent communication and collaboration abilities.

2. Application Developer

The main reason why the mobile app development business has gained momentum is that the eCommerce business has become more gigantic and the number of users each day is growing exponentially.

According to App Annie (www.appannie.com), consumer spending on apps will reach $139 billion in 2021. They also predict that it will become a market worth over $6 trillion.

An application developer is responsible for developing and modifying source code for software applications. These applications are aimed at aiding customers with computer tasks or programs.

According to Betterteam (www.betterteam.com), the Application Developer’s responsibilities and requirements are as follows:

Application Developer Responsibilities:

- Developing software solutions to meet customer needs.

- Creating and implementing the source code of new applications.

- Testing source code and debugging code.

- Evaluating existing applications and performing updates and modifications.

- Developing technical handbooks to represent the design and code of new applications.

Application Developer Requirements:

- A bachelor’s degree in computer science or a related field.

- Working knowledge of programming languages such as Java and ORACLE.

- Experience in application and software development.

- Knowledge of software design and programming principles.

- Good mathematical and problem-solving skills.

- Good communication and team-working skills.

3. Data Analysts

Customer data analysis is what will eventually allow Fintech companies to stay competitive. The only way for Fintech providers to stay in the game will be to hire talent or outsource.

According to Coursera, transitioning to a career in data analytics can mean stable employment in a high-paying industry once you have the right skills. Refer to their article here: 7 In-Demand Data Analyst Skills to Get Hired in 2021.

According to Betterteam (www.betterteam.com), Data Analyst’s responsibilities and requirements are as follows:

Data Analyst Responsibilities:

- Managing master data, including creation, updates, and deletion.

- Managing users and user roles.

- Provide quality assurance of imported data, working with quality assurance analysts if necessary.

- Commissioning and decommissioning of data sets.

- Processing confidential data and information according to guidelines.

- Helping develop reports and analysis.

- Managing and designing the reporting environment, including data sources, security, and metadata.

- Supporting the data warehouse in identifying and revising reporting requirements.

- Supporting initiatives for data integrity and normalization.

- Assessing tests and implementing new or upgraded software and assisting with strategic decisions on new systems.

- Generating reports from single or multiple systems.

- Troubleshooting the reporting database environment and reports.

- Evaluating changes and updates to source production systems.

- Training end-users on new reports and dashboards.

- Providing technical expertise in data storage structures, data mining, and data cleansing.

Data Analyst Requirements:

- Bachelor’s degree from an accredited university or college in computer science.

- Work experience as a data analyst or in a related field.

- Ability to work with stakeholders to assess potential risks.

- Ability to analyze existing tools and databases and provide software solution recommendations.

- Ability to translate business requirements into non-technical, lay terms.

- High-level experience in methodologies and processes for managing large-scale databases.

- Demonstrated experience in handling large data sets and relational databases.

- Understanding of addressing and metadata standards.

- High-level written and verbal communication skills.

4. Artificial intelligence Specialist

The financial services industry flourishes on informed decision-making, from extending credit to consumers to evaluating risks.

In recent years, artificial intelligence (AI) and machine learning (ML) have helped businesses make fast and critical decisions with data and insight.

Across the industry, organizations have turned to these technologies to transform their business through anti-money laundering (AML) pattern detection, chatbots, risk management, fraud prevention, network security, and investment predictions.

According to ‘recooty’, (https://recooty.com/blog/artificial-intelligence-specialist-job-description-template/), Artificial Intelligence Specialist’s responsibilities and requirements are as follows:

Such a specialist is required to develop programs that solve client issues and enhance AEE their work easier. They should be using deep learning, NLP, chatbots, etc. to stimulate business growth with innovative ideas. Such persons will contribute to shaping Artificial Intelligence strategies. Their motive will be to use the potential of Artificial Intelligence and help the organization to achieve its goals.

Artificial Intelligence Specialist’s Responsibilities :

- Formulate Artificial Intelligence strategies.

- Supervise research and development processes and other processes to make sure they fulfill the needs of AI strategies.

- Recognize the company’s goals and also the challenges faced by potential clients.

- Figure out the ways in which Artificial intelligence can be used to solve issues faced by clients and also enhance user experience.

- Collaborate with cross-functional teams to analyze the partner’s business and main areas where the application of AI can stimulate business growth.

- Set high ethical standards while applying Artificial Intelligence.

- Describe AI solutions clearly to everyone.

- Develop an efficient prototype.

- Work closely with the executives and engineers to finalize the design.

- Manage the AI team to perform tasks like the assessment of AI, automation market, etc.

- Perform tests before the delivery final application.

- Analyze the final project, give feedback, determine areas of improvement, and help the project team to make necessary changes.

Artificial Intelligence Specialist’s Requirements :

- Bachelor’s degree in Computer Science or other related courses.

- Proven experience in Artificial Intelligence, deep learning, and other relevant fields.

- Familiarity with functional design principles, object-oriented programming principles, basic algorithms.

- Hands-on experience in REST API and designs such as RDBMS design, NoSQL.

5. Cybersecurity / Information Security Specialist

The financial services business operates mostly on the back of digital and cloud-based technologies. While these applications substantially improve internal processes and customer service, there is also an unavoidable risk—increased vulnerability to malicious cyber threats.

The demand for expert cybersecurity or information security professionals is at an all-time high and is projected to continue rising. The fintech domain needs experts and specialists to develop security measures that thwart all malicious threats.

According to Betterteam (www.betterteam.com), Information Security Officer’s responsibilities and requirements are as follows:

Information Security Officer’s Responsibilities:

- Identifying vulnerabilities in our current network.

- Developing and implementing a comprehensive plan to secure our computing network.

- Monitoring network usage to ensure compliance with security policies.

- Keeping up to date with developments in IT security standards and threats.

- Performing penetration tests to find any flaws.

- Collaborating with management and the IT department to improve security.

- Documenting any security breaches and assessing their damage.

- Educating colleagues about security software and best practices for information security.

Information Security Officer Requirements:

- Degree in computer science or a technology-related field.

- Professional information security certification.

- Experience in an information security role.

- Solid knowledge of various information security frameworks.

- Excellent problem-solving and analytical skills.

- Ability to educate a non-technical audience about various security measures.

- Effective verbal and written communication skills.

6. Risk & Compliance Experts for RegTech

Technology is having a huge impact on the fintech industry’s regulations and rules. Therefore, there is a high demand for experts in the fields of finance law, best practices, and data security.

We can also expect regulation to become stricter and increasingly complex, which will further push the need for such experts.

As explained earlier, RegTech, or the Regulatory Technology, is the concept that brings together three essential elements, namely, people, data, and regulations, intending to enable firms to achieve a culture of compliance. It uses emerging tech such as machine learning and blockchain, to ultimately help businesses lower the cost and increase the efficiency of complying with regulations.

All these technologies support RegTech:

- Big data

- Blockchain

- Machine learning

- Artificial Intelligence (AI)

- Cloud computing

- Virtualization

- API

- Data mining and analytics

According to Deloitte (https://www2.deloitte.com/lu/en/pages/technology/articles/regtech-companies-compliance.html), various companies are engaged in different aspects of RegTech.

They have cited few prominent examples:

Companies doing Regulatory Reporting – Enable automated data distribution and regulatory reporting through big data analytics, real-time reporting, and cloud.

Companies doing Risk Management – Detect compliance and regulatory risks, assess risk exposure, and anticipate future threats.

Companies doing Identity Management & Control – Facilitate counter-party due diligence and Know Your Customer (KYC) procedures. AML and anti-fraud screening and detection.

Companies doing Compliance – Real-time monitoring and tracking of the current state of compliance and upcoming regulations.

Companies engaged in Transaction Monitoring – Solutions for real-time transaction monitoring and auditing. Leverage the benefits of distributed ledger through Blockchain technology and cryptocurrency.

Learning Resources

- Free Online Masterclass from CFTE – (https://courses.cfte.education/online-fintech-masterclass-learn-fintech-for-free/).

- Harvard University – This short course on Fintech provides expert guidance and insight into the shifting nature of the financial sector (https://online-learning.harvard.edu/course/fintech?delta=0).

- Fintex Courses from EdX – (https://www.edx.org/learn/fintech).

- Fintech Courses from Coursera – (https://www.coursera.org/courses?query=fintech).

- Learn Fintech from Wharton Online, Wharton University – (https://online.wharton.upenn.edu/fintech-specialization/).

- Academic and Professional Fintech courses from Fintech Alliance – (https://fintech-alliance.com/index.php/learning).

- Learn online Fintech courses from Uday Fintech Education Platform – (https://fintecheducation.com/).

- 10 Best Fintech Courses & Certification – (https://digitaldefynd.com/best-fintech-courses/).